The recent case of State Farm Mutual Automobile Insurance Co. v. Osborne (Osborne) warns against the perils of thinking you have insurance when you don’t. Because employees of businesses lease vehicles, the reasoning of the Osborne case serves as a warning to businesses as well.

The facts of the Osborne case are straightforward. Osborne rented a Hertz rental car to drive from Illinois to Florida. In Georgia, the car collided with a truck driving the wrong way, killing two in the car and severely injuring another.

The truck driver’s insurance was insufficient, and therefore, Osborne’s Policy was triggered to cover an “underinsured” vehicle.

The Policy defined “Insured,” that is, the person to whom benefits can be paid, to include “any person occupying (a) your car, (b) a newly acquired car, or (c) a temporary substitute car.” Parts (a) and (b) did not apply as Osborne did not own the Hertz rental car.

Digging further, a “Temporary Substitute Car” was defined as “a car that is in the lawful possession of the person operating it and that replaces your car for a short time while your car is out of use due to its (a) breakdown; (b) repair; (c) servicing; (d) damage; or (e) theft.”

The Court found that although the car the Osborne family owned, a 2004 Chevrolet Suburban, had high mileage, and broken air conditioning, nothing mechanically could be identified that made the car unsafe. The Suburban was “not out of use” for the reasons the Policy covered (i.e., breakdown, repair, servicing, damage or theft). As with most things, a simple review of insurance coverage before the trip would have resolved any questions.

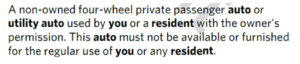

We have reviewed hundreds of Policies of Insurance and identified, that under identical facts, there would be coverage under certain Policies that contain the following additional language (taken from an actual policy):

It is said that a wise person learns from experience, but the wisest learns from the experience of others. The Osborne case stands as an example.

Whether it is students driving to college, a family vacation, or employees on a business trip, a timely review of your Policy of Insurance can make all the difference. Please let us know if we can help.

image cred: https://www.aoa.org/news/practice-management/perfect-your-practice/life-insurance-questions-answered?sso=y